UniCredit CEO Federico Ghizzoni on

Thursday confirmed the bank will commit one billion euros to the

new Atlante fund to aid troubled Italian lenders.

"We intend to remain in the fund for the expected five

years, with the possibility of renewing our commitment for

another three years," Ghizzoni said.

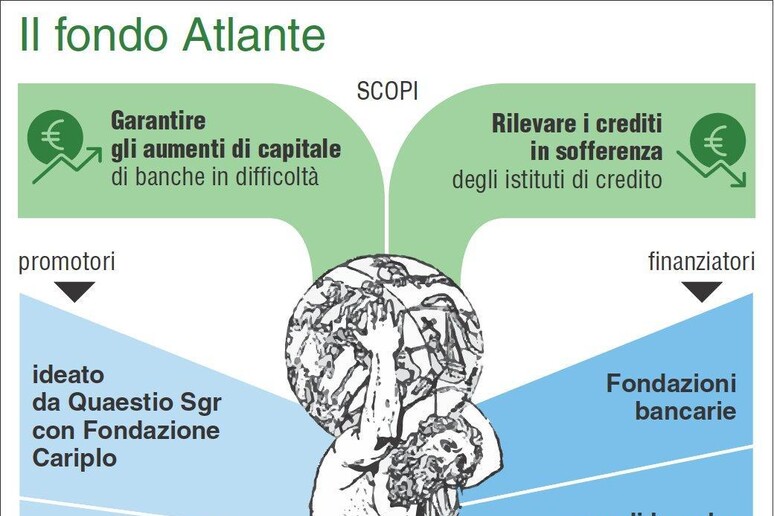

Atlante was set up by the Cariplo Foundation and Quaestio

capital management firm in a bid to shore up ailing Italian

lenders while avoiding violating EU rules against State aid.

Cariplo Foundation President Giuseppe Guzzetti said the new

fund will put an end to what he called a speculators' "bonanza"

in snapping up Non-Performing Loans (NPLs) at as much as 18-20%

interest.

The financial industry approved a government-backed plan

Monday to set up the privately financed fund to buy up shares in

struggling Italian lenders and to take on their NPLs.

Also on Thursday, IMF Managing Director Christine Lagarde

said Atlante showed "an interesting approach, limited in scope

and amount, but interesting".

Bad loans are a legacy of the financial crisis, she said,

and Italian authorities have recognised it is a problem that

must be addressed.

Economy Minister Pier Carlo Padoan told America's CNBC that

the creation of the fund was not a "bailout", but a "private

sector" initiative that aimed at "jump starting" the market for

non-performing loans.

ALL RIGHTS RESERVED © Copyright ANSA